What EV Charging Incentives are Available in 2024?

The shift to electric vehicles (EVs) is gaining momentum, and businesses across the country are increasingly looking for ways to invest in EV charging infrastructure. If you’re considering purchasing an EV charging station for your business, you may be eligible for a range of financial incentives and rebates that can significantly lower your installation costs. In this article, we’ll explore the various EV charging incentives available in 2024 and how you can take advantage of them to buy an EV charging station for your business.

Why Buy an EV Charging Station for Your Business?

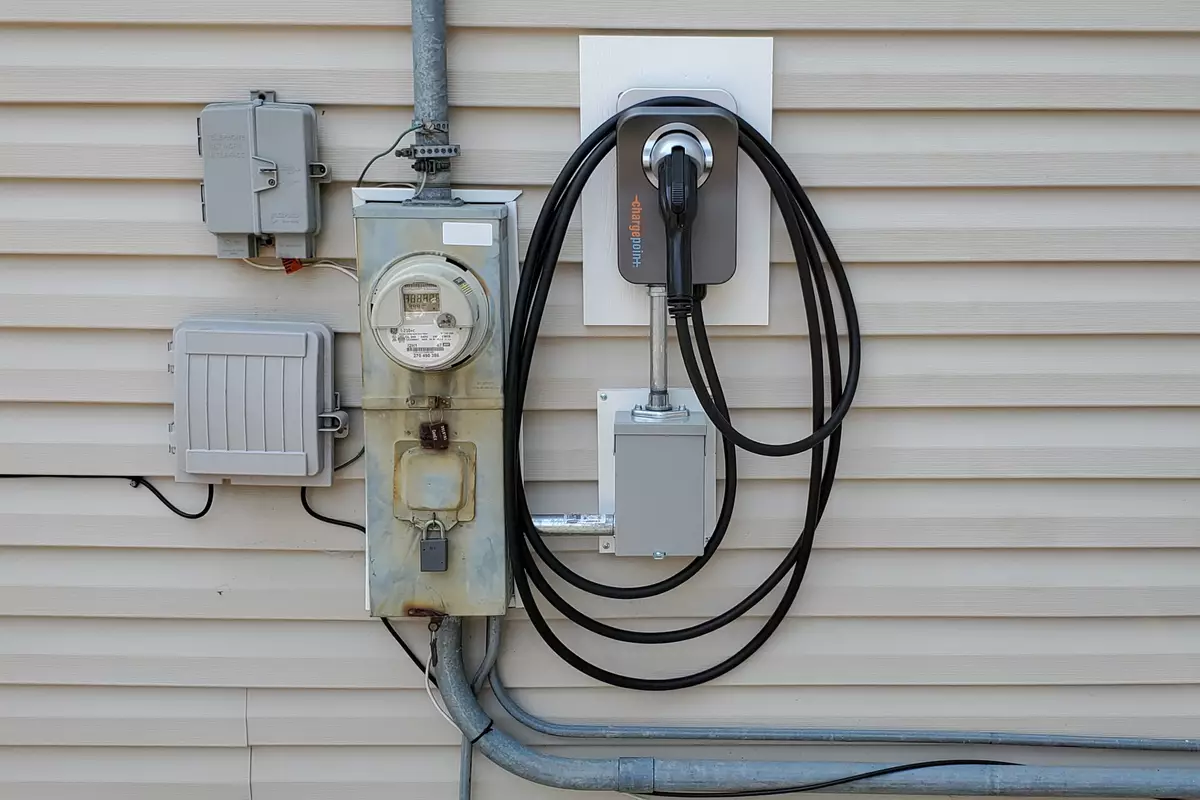

As more consumers switch to electric vehicles, offering EV charging stations can set your business apart by attracting customers and enhancing employee satisfaction. Whether you’re managing a retail center, multifamily property, or corporate office, installing an EV charger can add value to your business, increase foot traffic, and demonstrate a commitment to sustainability. In addition, businesses can profit from EV charging stations by offering paid charging services or using them as an incentive for tenants and employees.

However, one of the key considerations when investing in EV charging infrastructure is the cost. Fortunately, numerous incentives, grants, and rebates are available to help businesses offset these costs.

Types of EV Charging Incentives Available in 2024

In 2024, there are several types of incentives designed to encourage businesses to buy EV charging stations. These incentives include federal tax credits, state-specific grants, utility company rebates, and local government programs. Let’s dive into each of these in detail.

1. Federal Incentives

The U.S. federal government continues to support the adoption of electric vehicles through various programs aimed at lowering the upfront cost of charging stations. Here are the key federal incentives available in 2024:

- 30C Alternative Fuel Infrastructure Tax Credit: Extended through 2024, this incentive allows businesses to claim a tax credit of up to 30% of the total installation costs for EV charging stations, with a cap of $100,000 per property. This tax credit applies to both the purchase and installation of the EV charging equipment.

- Inflation Reduction Act (IRA) Grants: The Inflation Reduction Act, passed in 2022, allocates significant funding for clean energy projects, including the development of EV charging infrastructure. While many of these programs are administered at the state level, federal grants are available for businesses looking to install EV chargers, especially in underserved communities and rural areas.

2. State and Local Incentives

State and local governments often provide additional incentives on top of federal programs to encourage businesses to buy EV charging stations. These incentives vary significantly depending on where your business is located, but here are a few common examples:

- California’s CALeVIP Program: One of the most generous state programs, CALeVIP provides rebates to businesses installing Level 2 or DC fast chargers in California. These rebates can cover up to 75% of the project’s total cost, depending on the location and type of charger.

- New York’s NYSERDA Incentives: New York offers rebates of up to $4,000 per Level 2 charger through its NYSERDA Clean Energy program. Additional incentives are available for businesses in disadvantaged communities.

- Other States: States like Massachusetts, Oregon, Washington, and Colorado also have strong incentive programs that reduce the cost of installing EV chargers. Be sure to check your state’s Department of Energy or transportation website for available programs.

3. Utility Company Rebates

Many utility companies across the U.S. offer rebates and incentives for businesses that purchase and install EV charging stations. These utility programs are often structured to support grid reliability and encourage off-peak charging, helping both businesses and the electrical grid manage energy demand more efficiently.

- Southern California Edison (SCE): SCE provides rebates of up to $80,000 per DC fast charger and up to $15,000 for Level 2 chargers for businesses in their service area.

- Con Edison (New York): Con Edison offers incentives for businesses installing chargers through its PowerReady Program. Rebates can cover up to 100% of the cost of installing Level 2 or fast chargers.

- Pacific Gas & Electric (PG&E): PG&E’s EV Charge Network provides incentives for multifamily properties and businesses to install EV charging stations, with rebates that can cover 50%-100% of installation costs depending on the location.

- Other Utilities: Utility rebates are available across the country from companies like Xcel Energy, Dominion Energy, and Duke Energy. Be sure to contact your local utility provider to find out what rebates or assistance they offer.

4. Local Government Programs

Local municipalities are also getting involved in promoting EV infrastructure by offering grants and rebates for EV charger installations. Many cities and counties offer incentives to businesses looking to install chargers in public or private parking lots.

For example, the City of Los Angeles provides additional rebates for businesses that install chargers in areas with high traffic, while Chicago offers incentives through the Drive Clean Chicago program.

How to Take Advantage of EV Charging Incentives

Now that you know about the various incentives available in 2024, how can you take advantage of them to buy an EV charging station for your business? Here are a few steps to ensure you maximize your savings:

- Research Federal, State, and Local Programs: Start by researching the available incentives in your area. This includes checking federal tax credit options, state-level rebates, utility programs, and local government grants.

- Consult an EV Charging Specialist: Partner with a company like Evri Network that specializes in EV charging solutions for businesses. They can help you navigate the application process for rebates and ensure that your installation meets all eligibility requirements.

- Choose the Right Charging Station: Select the type of EV charging station that best fits your business needs. Whether it’s a Level 2 charger for employee parking or a DC fast charger for public use, make sure your choice aligns with the incentives available in your area.

- Apply for Incentives Early: Many incentive programs have limited funding, and rebates are often provided on a first-come, first-served basis. Apply for available programs early to secure your rebates.

- Track Your Expenses: Keep detailed records of your expenses for the EV charger purchase and installation, as you’ll need them when applying for tax credits and rebates.

Conclusion

With the right incentives, investing in EV charging stations for your business can be more affordable than ever. The combination of federal tax credits, state rebates, utility company programs, and local incentives provides businesses with significant savings on EV charging station purchases and installations.

If you’re ready to buy an EV charging station for your business, Evri Network can guide you through the process and ensure you take full advantage of the available incentives in 2024. Contact us today to learn more about how we can help you enhance your property with EV charging infrastructure.